7 Expensive Bookkeeping Mistakes Startups Make (And How to Avoid Them)

Introduction

Most startup founders think bookkeeping is just “data entry.” They ignore it until tax season—and that is a fatal mistake.

Bad bookkeeping doesn’t just annoy your accountant; it kills your cash flow, triggers IRS audits, and scares away investors.

I have seen profitable businesses go bankrupt simply because they didn’t know where their money was going. In this guide, we cover the 7 most dangerous bookkeeping mistakes new founders make—and exactly how to fix them.

1. Mixing Personal and Business Finances

This is the #1 sin of small business. You buy a coffee with the company card, or pay for software with your personal card.

Why it’s dangerous: It “pierces the corporate veil.” If you get sued, lawyers can come after your personal house and car because you treated the business account like a personal piggy bank.

The Fix: Open a dedicated business bank account immediately. Never mix the two.

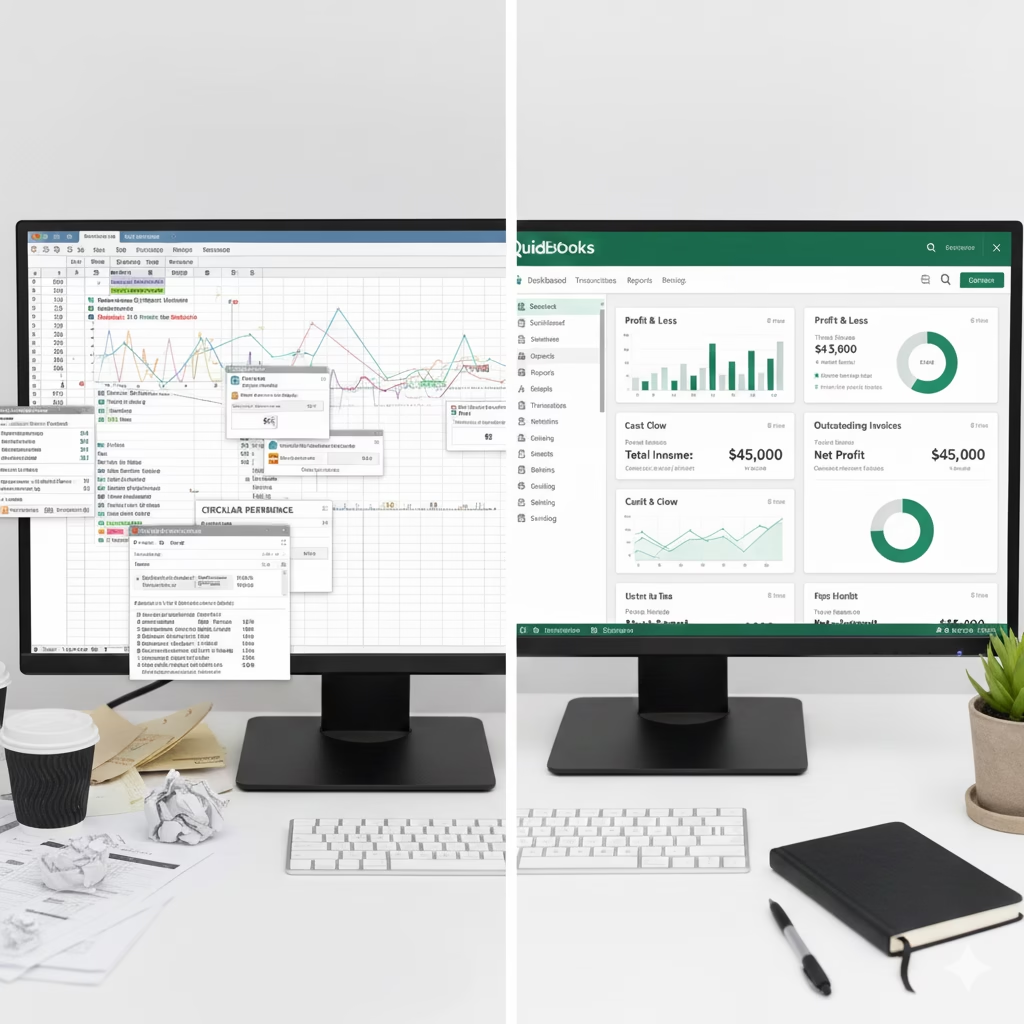

2. Relying on Spreadsheets (Excel Hell)

Excel is great for financial modeling, but it is terrible for bookkeeping. It doesn’t automate anything, it’s prone to human error, and it doesn’t connect to your bank.

The Fix: Use automated software. Tools like QuickBooks Online or Xero automatically pull your transactions from the bank, so you never miss an expense. 👉 Read our review of the Best Bookkeeping Software here

3. Throwing Away Receipts

“I’ll find it later.” No, you won’t. The IRS requires proof for expenses over $75, but for startups, you should keep everything. If you get audited and can’t prove an expense, you owe the tax—plus penalties.

The Fix: Use a digital receipt scanner. Apps like Dext or the QuickBooks Mobile App let you snap a photo of a receipt and throw the paper away.

4. Categorizing Everything as “General Expense”

When you don’t know what an expense is, you dump it into “General Expenses” or “Miscellaneous.” If this category gets too big, it raises a red flag for tax auditors. They know you are hiding things there.

The Fix: Create specific categories like “Software,” “Travel,” “Office Supplies,” and “Marketing.”

5. Ignoring Sales Tax

If you sell digital products or ship goods across state lines, you might owe Sales Tax in that state. Many founders don’t realize this until they get a massive bill from a state government years later.

The Fix: Use software that calculates this for you. Zoho Books and QuickBooks have built-in sales tax estimators.

6. Treating Employees like Contractors

You hire someone, pay them a flat fee, and call them a “freelancer” to avoid paying payroll taxes. If the government decides they are actually an employee (because you set their hours and provide equipment), you will be fined for unpaid taxes.

The Fix: Know the labor laws. If they work 9-5 for you, put them on payroll.

7. DIY Bookkeeping When You Are Scaling

In the beginning, doing it yourself saves money. But once you hit $10k/month, your time is worth more than $50/hour. If you spend 5 hours a month on books, you are losing money.

The Fix: Outsource it. You can hire a remote bookkeeper or use a service like Bench. 👉 Compare outsourced bookkeeping options here

Conclusion

Bookkeeping isn’t the most exciting part of a startup, but it is the foundation of your success. Avoid these 7 mistakes, and you will sleep much better at night.

Ready to upgrade your financial setup? Stop using spreadsheets and start using professional tools. Check out our guide on the Top 5 Client Bookkeeping Solutions for 2025.