Restaurant Tax Guide 2026: How the “No Tax on Tips” Rule Actually Works

Introduction

The headlines say “No Tax on Tips.” But if you read the fine print of the One Big Beautiful Bill Act, it’s a bit more complicated than that.

Yes, starting with the 2025 tax year (filed in 2026), servers and bartenders can deduct up to $25,000 in tip income from their federal taxes. However, for restaurant owners, this creates a new compliance minefield.

For the 2026 tax year, the IRS requires new “Occupation Codes” on W-2 forms. If you, the owner, do not report these codes correctly, your employees will be disqualified from the deduction—and they will likely quit.

In this guide, we break down exactly how the deduction works for staff, the new W-2 reporting rules for owners, and why the FICA Tip Credit is now more valuable than ever.

1. For Servers: How the $25,000 Deduction Works

It is not an automatic tax exemption. It is a “Below-the-Line” Deduction.

- The Limit: You can deduct up to $25,000 of tip income per year.

- The Restriction: It only applies to Federal Income Tax. You still have to pay Payroll Taxes (Social Security & Medicare) on every dollar.

- The Eligibility: It applies to tips that are “voluntarily” given (cash or credit). Mandatory “Service Charges” (auto-gratuity) do NOT count.

Example:

- You earn $40,000 in wages and $30,000 in tips.

- Total Income: $70,000.

- Old Rule: You pay income tax on $70,000.

- 2026 Rule: You deduct $25,000. You only pay income tax on **$45,000**.

⚠️ Warning for High Earners: The deduction phases out if your Adjusted Gross Income (AGI) exceeds $150,000 (single) or $300,000 (married).

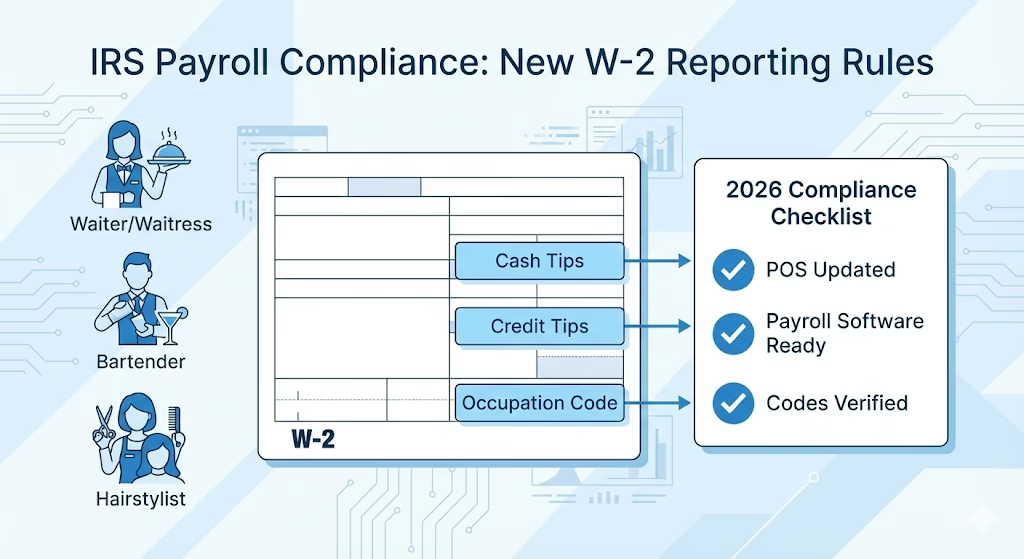

2. For Owners: The New W-2 “Occupation Codes”

This is where restaurant owners need to pay attention. To prevent fraud (e.g., hedge fund managers claiming their bonuses are “tips”), the IRS now requires you to validate the employee’s role.

The 2026 Requirement: On the 2026 W-2 (filed in Jan 2027), you must separate Cash Tips from wages and assign a specific “Tip Occupation Code” to each employee.

- Code Examples (Hypothetical): “Waiters/Waitresses,” “Bartenders,” “Hairstylists.”

Action Item: Check your Payroll/POS software now. Does it support “Occupation Codes”? If you use an older system, you might be blocking your staff from their tax break. 👉 See which POS systems are 2026 Compliant

3. The FICA Tip Credit (Section 45B)

While your employees get a deduction, you get a credit. The FICA Tip Credit allows owners to claim a tax credit for the Social Security and Medicare taxes they pay on employee tips.

The 2026 Update: The One Big Beautiful Bill Act has made this credit permanent and expanded it to other industries (like salons), but it remains a powerhouse for restaurants.

How it works:

- You pay 7.65% payroll tax on your employee’s tips.

- The IRS gives that money back to you as a dollar-for-dollar tax credit against your business income taxes.

- Note: You cannot claim the credit on tips used to bring the employee up to the minimum wage ($5.15/hr freeze rate).

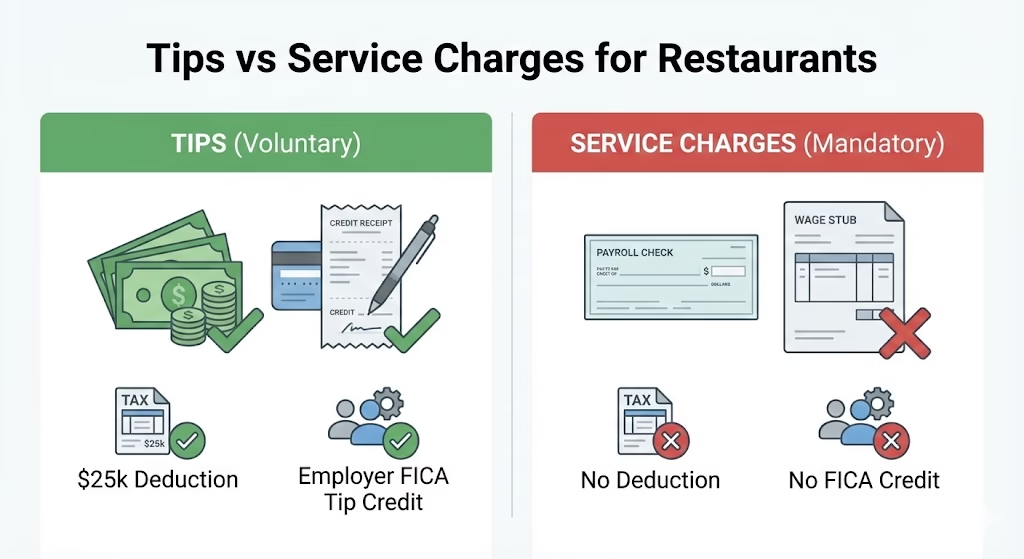

4. “Service Charges” vs. “Tips” (The Trap)

Many restaurants are switching to a “Service Charge” model (e.g., “20% added to all checks”) to pay fair wages. Be careful.

- Tips: Voluntary. Eligible for the employee’s $25k deduction. Eligible for the employer’s FICA credit.

- Service Charges: Mandatory. These are treated as Regular Wages. They are NOT eligible for the $25k deduction, and you do NOT get the FICA credit.

The Verdict: If you switch to Service Charges in 2026, your staff might actually take home less money because they lose their tax break.

Conclusion: Update Your Systems

The “No Tax on Tips” law is a win-win, but only if the paperwork is perfect.

- Servers: Track your cash tips. If you don’t report them to your boss, they don’t go on the W-2, and you can’t deduct them.

- Owners: Call your payroll provider. Ask: “Are we ready for the 2026 Tip Occupation Codes?”

Need a POS that handles this automatically? 👉 Review: Best Restaurant POS Systems (Toast vs. Square)